Here’s A CPAs View Of How The Proposed GOP Tax Code Affects You

So what do local tax preparers have to say about how the GOP tax plan will affect our pocketbooks?

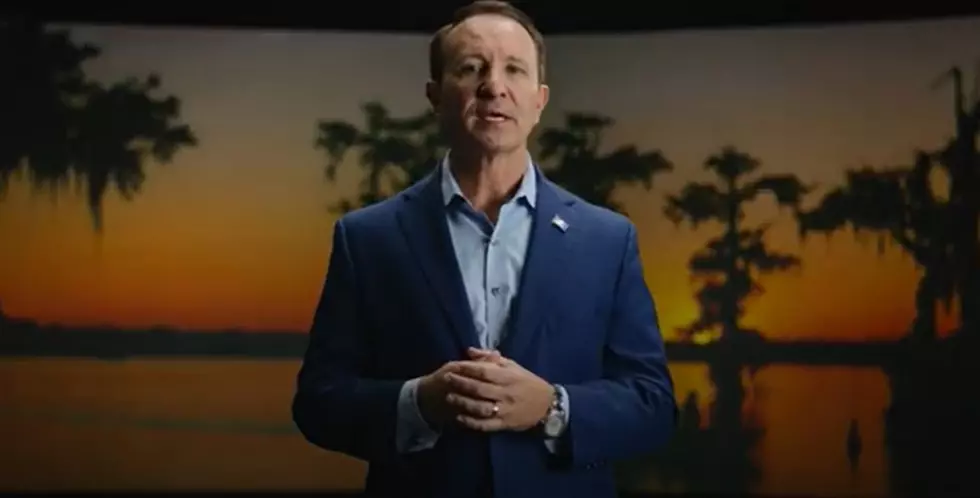

Among the changes, the plan eliminates the ability to deduct state income tax, which is between two and six percent in Louisiana. Brandon Legarde with the Society of Louisiana CPA’s says that one change impacts everyone.

"It's a big deduction for people. Louisiana is typically not a high income taxing state, but states like California and New York and others are. There's been a lot of push back on the that."

One of the reasons the GOP is happy with tax reform is the change afforded to businesses in trying to urge corporations to come back to the U.S. Legarde says his office is still trying to determine how all the tax breaks will benefit businesses and if they will be able to get around some of the new laws.

"We're still scratching our head trying to figure out how is this will really shake out

when it's all said and done. And will there be quote loopholes that will be discovered through the process."

Legarde says even with the promise of being able to file your taxes on a postcard, the simplicity of the tax code remains to be seen, keeping accountants on their toes.

"It's still complicated and will be by and large. It will keep us busy."

More From News Talk 96.5 KPEL