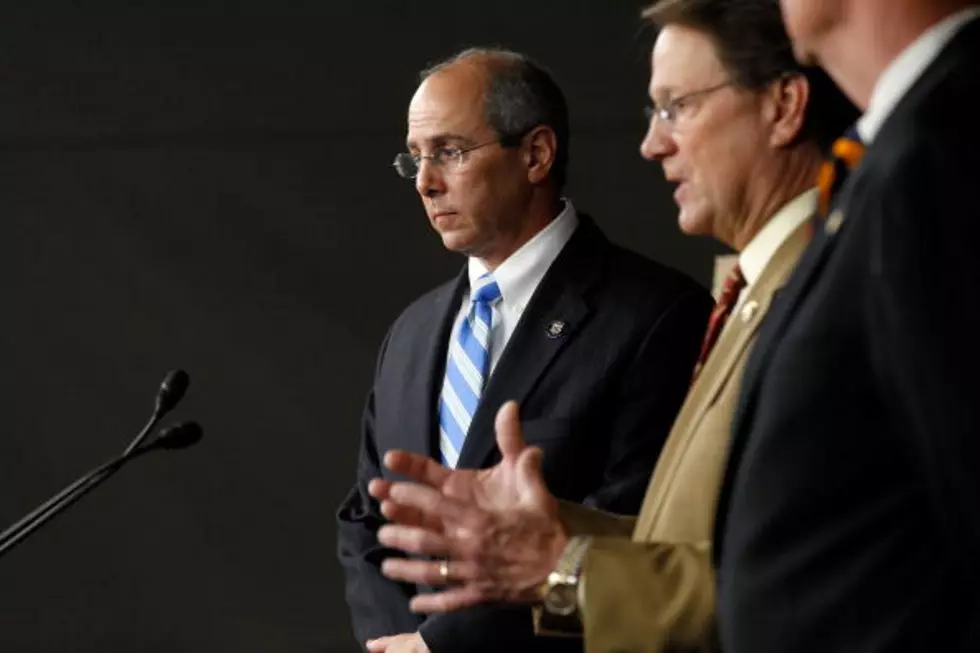

Boustany Speaks Against Tax Increases On American Families And Businesses

Washington, D.C. – U.S. Representative Charles W. Boustany, Jr., (R-Southwest Louisiana), today made the following remarks on the House floor in support of H.R. 4853, the Middle Class Tax Relief Act of 2010. The legislation would prevent a tax increase of $3.8 trillion on American families and businesses.

Boustany’s remarks:

“Mr. Speaker, indeed this is a sad state of affairs in which we find ourselves having to deal with this in the waning days of the 111th congress. In just a mere 16 days, a massive tax increase, $3.8 trillion, will hit every American taxpayer at a time when we're dealing with high unemployment, very sluggish economic growth and uncertainty about our future.

“American families and businesses have had uncertainty hanging over their heads for months and we've known about the date of the expiration of these tax provisions. It's time for this Congress to act. It's way past due.

“No one is satisfied. No one in this body, I'm sure, is satisfied completely with this bill. I certainly don't like provisions in it. But we may not like the situation that we find ourselves in, but it is this situation that determines our duty to act.

“Mr. Speaker, we cannot roll the dice with the American economy and the fate of American families and American businesses. That would be the height of irresponsibility and we've seen enough of that in this 111th Congress.

“Let's examine some of the provisions in this bill. If you vote yes, you're voting to prevent tax increases on working Americans, you're voting to prevent tax increases on small businesses and job-creating investments. If you vote no, you're voting for job-killing $3.8 trillion tax increase that kicks in on January 1 and it will be paid for by every taxpayer and most small businesses in this country. If you vote no you're basically voting to allow for the average middle class family to see $100 pulled out of their paycheck every week. That's a lot of money for the average family.

“If you vote yes you're voting to prevent a hike in the death tax on our family farmers and small business owners who take risks and have built farms and built small businesses, taking those risks in a uniquely American way. Why do we want to penalize that?

“Mr. Speaker, there are some who say on our side that we ought to wait, they may think it's good politics, they may think we may have more leverage. Well, it's not all that clear as to what could be gained if we were to wait. But I'll say this, Mr. Speaker, it's inevitable that there would be delays in enacting any kind of a package and as a result of the delays, months going by perhaps, we'll see a job-killing massive tax hike on everyone.

“For those concerned about the deficit, certainly a concern I share, this tax increase will basically hit economic growth, hit prosperity in this country like a category five hurricane. It will put us back into a recession. And the prospects to try to correct these problems will be even worse and make it much more difficult for us to act into the future.

“Let's be clear. This is not a pro-growth program, as my colleague, Mr. Ryan, said earlier. This is a two-year agreement. It's a first step, the first step in correcting the severe problems that we find ourselves in. This will give us time to move forward with fundamental tax reform which when coupled with spending decreases, cutting spending, can get our country back on a sustainable economic course. A sustainable path to prosperity, a sustainable path

to restore American competitiveness and to restore American leadership at a time when we need to do this for the position of economic strength.

“So let's clear the slate so that we can start anew in January to get our country back on a competitive basis. I urge our colleagues on both sides of the aisle to support the passage of this bill and I yield back the balance of my time.”

More From News Talk 96.5 KPEL