Need to Know: FEMA Changes Their Flood Insurance Policy

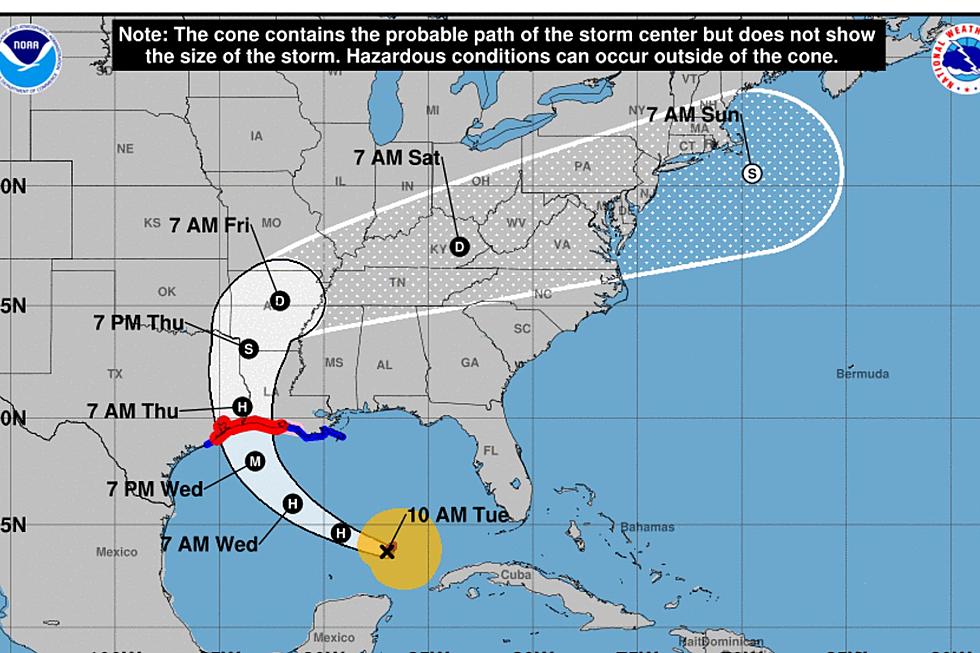

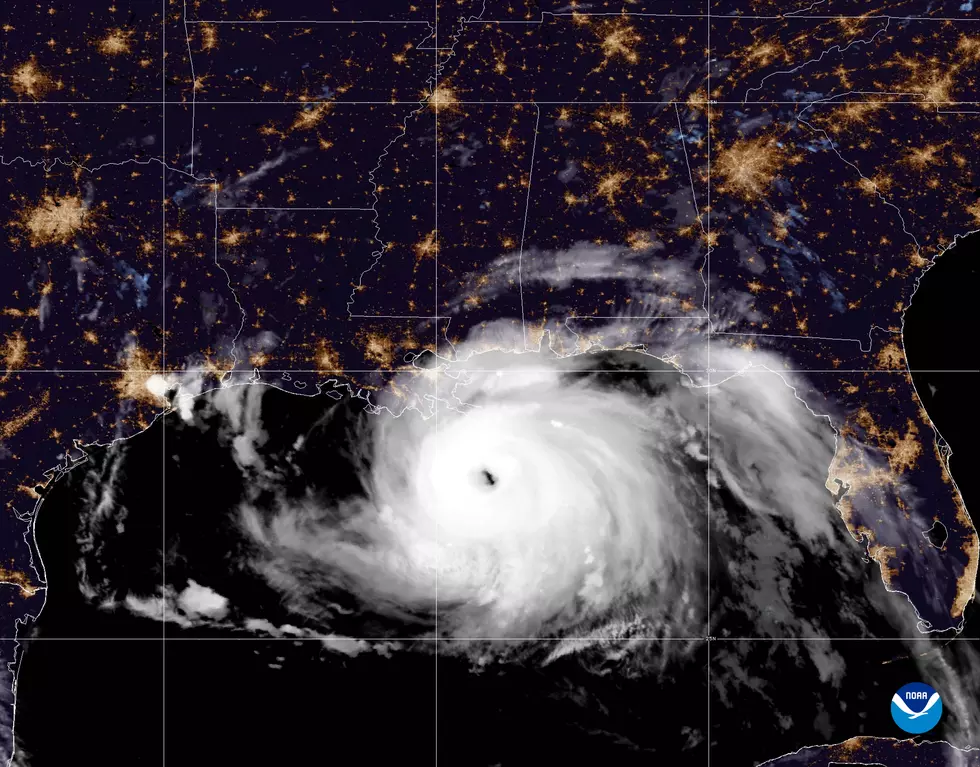

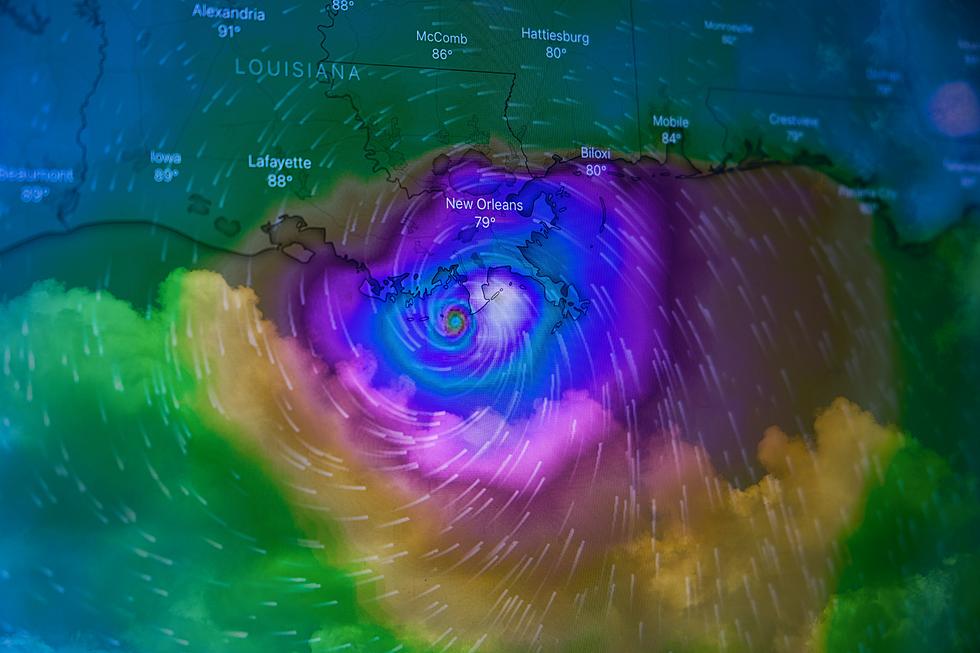

We are still in the middle of hurricane season, despite the fact that a big portion of Louisiana is still recuperating from a disastrous 2021 season already. Hurricane Ida has wreaked havoc on our southeastern friends and neighbors, and if we're being honest, lots of Louisiana folks are still trying to recover from the 2020 season. If you don't believe it, just take a ride through Lake Charles and see all the blue tarps still on roofs. We are extremely sad for everyone who has been affected by these "natural disasters" in our state.

And now comes news that FEMA (Federal Emergency Management Agency) is changing their flood insurance policy. And yes, it is going to affect us right here in the Bayou State.

On Friday, October 1, FEMA began implementing a new policy change for flood insurance holders. According to a press release via KLFY, the policy change will “fundamentally change the way FEMA prices insurance and determines an individual property’s flood risk. With the implementation of Risk Rating 2.0, FEMA said they will provide rates that will more accurately reflect an individual’s flood risk, and they will no longer pay based on the value of their home."

According to KLFY at least 80% of Louisiana policy holders will see an increase, but 20% will see a decrease. Nick Vinzant with QuoteWizard says “The way FEMA used to base flooding was essentially the value of the home and where you live. It is [now] based on individual risk. That is the big difference” In addition, beginning April 1, 2022, the remaining policies will be using the new price plan at the time of renewal. Read more about the policy changes from KLFY.

10 Handy Home Remedies to Take the Itch Out of Mosquito Bites

More From News Talk 96.5 KPEL